West End Hub

Housing and Community Development

*This website is still a work in progress!

Overview

Metro trends suggesting the re-urbanization of Atlanta combined with the West End's existing assets and proximity to the central business district indicate a possible shift in the study area's housing market (including an increase in rents, property values and the number of housing sales). Additionally, the West End Studio has proposed several multi-million dollar public/private projects that, if instituted, will most likely increase economic activity and substantially impact long-term housing and rental values. Recognizing the potential market pressures and the inevitability of rising housing costs within the study area, the studio has explored opportunities to maintain a vibrant community by preserving some affordability within the housing market. (Youngblood, 2003) The following is a brief analysis of the West End housing market and possible opportunities for addressing the impacts of gentrification while fostering a healthy, mixed-income environment for private investment and economic growth.

The West End CommunityThe West End is strategically located on the southwestern portion of Atlanta, sandwiched between the Atlanta Central Business District and the new Falcons stadium project to the north and the Fort McPherson proposed redevelopment project to the South (See Appendix A). The neighborhood contains a mixture of newer multi-family units, live-work lofts, and historic single family homes that are relatively affordable compared to other similarly situated historic neighborhoods (e.g., Grant Park and Kirkwood's historic housing stock). Additionally, new public and private projects, such as the Atlanta Beltline and the redevelopment of the Candler-Smith Warehouse, have begun to shed light on the West End as a desirable, in-town neighborhood.

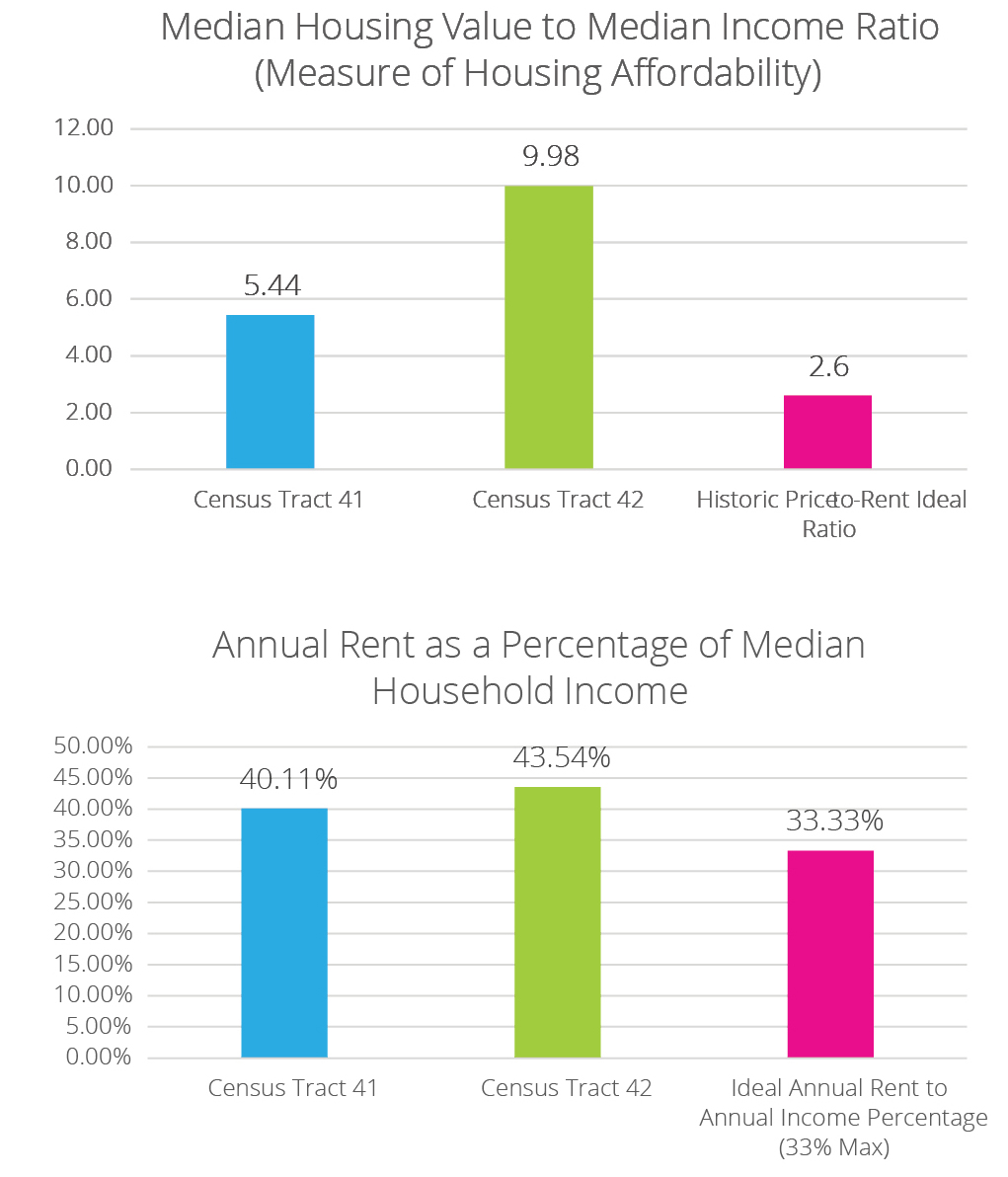

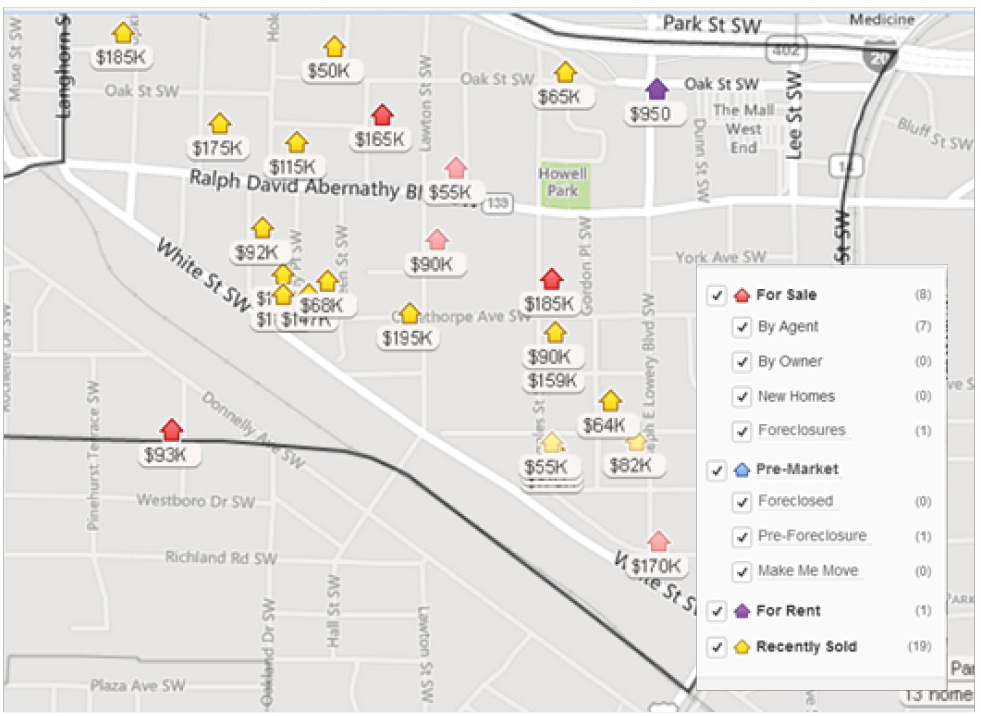

Currently, housing information from the study area indicates a significant gap between median household income and both median housing values and rents. In particular, information for Census Tracts 41 & 42, where the majority of the single-family housing stock is located, demonstrates an unfavorable affordable housing market for those with annual incomes near the median household income threshold for the area. Figures 25 and 26 show the price-to-income and rent-to-income percentage for Census Tracts 41 & 42 compared to standard thresholds for affordability (based on 2008-2012 ACS 5-Year Estimates). While Figure 26 shows that rents are currently much higher (40.11% and 43.54% respectively) than the 33% threshold for maintaining affordable rental options within the market, median housing values indicate that homeownership opportunities may already be out-of-reach for many residents. For example, for residents in Census Tract 42 to have the ability to afford a home at the median house value level ($195,000), they would need a median household income of $78,000. Finally, Figure 27 maps the past 6 months of sales in the study area. According to Zillow, property sales have ranged from $60,000 - $195,000. Several of the current sales (in red) are on the market near $160,000 - $190,000 and may encompass homes that have been rehabilitated in the past few years.

Housing and Rent Values

Map of the sales in the West End Study Area for the past 6 months (November 22, 2013 - April 22, 2014) Source: Zillow)

Strengths, Weaknesses, Opportunities, & Threats (SWOT) Analysis

Below is a brief SWOT analysis that focuses on the current state of the study area's housing stock (both single-family and multi-family residential and rental units).

Strengths

- +The West End study area is located within the Beltline Affordable Housing Trust Fund (BAHTF), which provides a 15% of net bond proceeds dedicated to the trust fund through TAD funding. (Beltline)

- +For rental affordable housing: the ABAHTF recommends an income eligibility ceiling for affordable rental housing at 60% of AMI (2013 - $39,780). Additionally, the fund encourages development housing targeted for households either at or below 30% AMI (2013 - $19,900)

- +For ownership affordable housing: the ABAHTF recommends an income eligibility cap at 100% AMI for households with 1-2 people (2013 - $66,300)

- +The BAHTF offers developer incentives and grants for multi-family and single-family developments that meet these requirements

- +Many West End residential streets contain good single family housing stock (with historic homes) and beautiful tree lined canopies

- +The West End already has established developers (e.g., Integral, HJ Russell) within the district that are familiar with the community (e.g., market analysis) and have shown an interest in building affordable housing (public and LIHTC)

Weaknesses

- +Due to the West End's high vacancy rate (33.4%), the neighborhood may be vulnerable to increasing housing speculation and market pressures

- +Cost of maintaining a home may be subject to the HD-20G historic overlay district

- +High amount of renters (74%) may be subject to higher rental rates due to the lack of adequate rent control laws

- +BAHTF AMI caps for single-family for sale units may be out-of-reach for the current median household income in the West End. Thus, current development incentives may not be an effective strategy for the West End's current affordable housing needs

- +While recent developments may hopefully indicate a position change by the Fulton County Tax Commissioner regarding the office's relationship with the Fulton County/City of Atlanta Land Bank Authority (see April 2014 AJC article regarding Arthur Ferdinand working with the Land Bank to waive the Historic District Development Corporation's (HDDC) delinquent property taxes on HDDC owned properties), historically, the Tax Commissioner has not effectively worked together with the Land Bank to waive delinquent taxes on blighted properties and help jumpstart the revitalization process.

- +For Community Land Trusts, local community development activities and overall neighborhood-redevelopment plans to flourish, the Tax Commissioner's office must continue to work with the Fulton County/City of Atlanta Land Bank Authority to waive delinquent taxes on properties that could be used for affordable housing and community redevelopment strategies

- +A strong relationship between the tax commissioner, local land bank and neighborhood land trust are a best practice for dealing with an efficient and effective property acquisition and affordable housing rehabilitation strategy

- +The older single-family housing stock may require significant and costly rehabilitation (e.g., up-to-date insulation, historic window requirements) that may impact the affordability of the single-family rental and for sale markets

- +Low income renters may be burdened with the high cost of heating and cooling an older, inefficient home leading to exorbitant utility costs

- +Significant rehabilitation requirements (e.g., insulation, historic overlay rehabilitation requirements) may hinder community land trust affordable housing rehab-and-sell efforts

Opportunities

- +Lots available for acquisition by a Community Land Trust or other affordable housing program/strategy (LIHTC)

- +Possibility to create a TOD component with affordable housing

- +Attracting faculty, students and staff from the AUC and surrounding office/medical land uses (e.g., West End Medical Center)

Threats

- +Increased value associated with the Beltline and proposed infrastructure projects may result in the lack of long-term affordable homeowner opportunities

- +These threats include possible substantial speculation & rapid gentrification (Dan Immergluck, July 2009)

Problem Statement

Given current re-urbanization trends in the Atlanta market, the neighborhood's current assets and intown location, the growth of property and rental values within the submarket and the West End Studio's proposed public infrastructure projects, how does the West End manage potential gentrification to maintain a vibrant, mixed-income community that is beneficial for private investors while maintaining future affordable housing opportunities?

Opportunities to Address the ProblemTalks with the West End community and private businesses indicate that the high level of vacancy and depressed property values should not be seen as a weakness; in fact, this should be seen as an opportunity. Given the proposals for redevelopment and revitalization outlined in this report, the West End is primed for investment now. While investment may lead to 'gentrification' of the West End, this should not be seen as the threat many think. Gentrification, if expected by the neighborhood and if controlled properly, can actually provide many benefits to a neighborhood. For example, gentrification can provide diversity of economic and social classes, improve quality of life, and limit the downside when the current upward cycle ends. However, if a neighborhood fails to limit the impacts of gentrification, it can result in large amount of resident displacement. A few of the tools that communities can use to limit the negative aspects of gentrification are Community Land Trusts, scattered site LIHTC, and Deed Restricted housing. Through the use of these tools, communities can provide a mechanism for those most vulnerable to rising property values a way to stay in their neighborhood if they desire.

Community Land Trusts

A CLT is a dual ownership model of property: one party holds the deed to a parcel of land; another party holds the deed to a residential building located upon that land. (Davis, 2006) Under the analogy of property as a "bundle of sticks", a typical purchase of a piece of property conveys the full "bundle of sticks" to the purchaser. But, under a CLT model of ownership some of the property rights are severed from the "bundle of sticks" because the full property is not being conveyed. The CLT holds the land in perpetuity and provides the owner of the building with exclusive use of the land. (Davis, 2006) This land is typically conveyed to the property owner through a ninety-nine year ground lease (which is renewable and inheritable). This model allows the CLT to take a portion of the housing stock out of the local real estate market and capture the equity gain for community benefit rather than the individual property owner. (Thomas, 2013) By capturing the gain for the community, the CLT can help preserve affordability and stabilize the neighborhood if it can acquire enough properties.

The basic model for purchasing or securing affordable housing is (Pastel, 1990):

Step 1: A community land trust purchases land on the open market within a designated community. The goal is to buy land at bargain prices to ensure affordability and the maximum use of funds.

Step 2: Once the homes meet the CLT's quality standards, the home structures are then either sold or rented to individuals who meet their affordable housing resident requirements. The homes are sold as little above the cost to rehabilitate or build as possible.

Step 3: A ground lease (usually for 99 years) is executed simultaneously for a nominal value and governs the relationship between the CLT and the residents. The CLT retains title to the land and the home owner gains title to the house.

Step 4: When the resident decides to sell the property, the ground lease provisions usually stipulate a restriction on the sale of the home, such as the CLT having the first right of refusal, to ensure that the home stays affordable and outside of the free market.

Step 5: Instead of getting the entire equity from the sale (equity = sale price - purchase price - selling costs - remaining debt), the resident gets a limited amount of equity based on a formula stipulated in the ground lease.

While the basic model for acquisition is relatively simple, the strategy for targeting and purchasing properties by a CLT, and the amount of property that can be acquired by a CLT, can vary greatly from CLT to CLT. The variation in the capabilities of a CLT can likely be attributed to the availability of resources and the capital available to a CLT.

There are many different roles that CLTs can play in their communities. Further, there are many different strategies CLTs can use to acquire and develop properties within the community. The strategies used to acquire and develop properties by a CLT will vary depending on what acquisition tools are currently allowed in the jurisdiction, and the support the local jurisdiction can give to the CLT. The basic strategies of acquisition are: fee simple acquisition from Land Banks and property purchases; negotiations with current residents to donate their land to the CLT; partnerships with developers; and donations from banks or other nonprofits. Some of the money available to purchase property may come from public and private grants, nonprofit funds, and donations to the nonprofit.

As for the development of the land once acquired, some CLTs assume major responsibility for the comprehensive redevelopment of a targeted locale; other CLTs may take sole responsibility for developing, marketing, and managing many types and tenures of housing; and some may leave most of these tasks to others, and confine their effort to assembling land, leasing land, and preserving the affordability of any housing located upon it. (Davis, 2006) "Between the extremes of the CLT-as-developer and the CLT-as steward lies a variety of roles, with every CLT deciding for itself what is should do and can do, given its mission, constituency, and capacity." (Davis, 2006)

Low Income Housing Tax Credits

Our research and talks with housing scholars suggests that in addition to traditional Low-Income Housing Tax Credits (LIHTC) for multi-family residential, LIHTC are also being used for scattered site housing. (Immergluck, 2014); (Cummings & DiPasquale, 1998) Recent changes to the Georgia Department of Community Affairs' Qualification Allocation Plan (QAP) indicate an interest and willingness to try and use LIHTC for single-family, scattered sight housing in Atlanta neighborhoods. (Kimura, 2012) Loosening the restrictions for scattered-site housing was a response to the state's recent foreclosure crisis and an attempt to promote the rehabilitation of vacant single-family units and public/private community revitalization. (Kimura, 2012) Seeing the potential in this new opportunity, the Department of Community Affairs awarded an annual $950,000 allocation of low income tax credits for Columbia Residential along with Summech Community Development Corporation to develop a project that combines traditional new multi-family LIHTC development with scattered site single-family, LIHTC rehabilitated housing in the Summerhill neighborhood. (Immergluck, 2014) (Khalil, 2014) Additionally, this new affordable housing opportunity provides on-going classes for residents on budgeting, housekeeping and ownership skills through Summech CDC. (Khalil, 2014) Finally, once the LIHTC 15-year compliance period is satisfied, there is an opportunity for the homes to be sold low and moderate income households that qualify for a mortgage. (Khalil, 2014)

LIHTC is a prominent federal program that subsidizes the construction and rehabilitation of low-income rental housing. (Kimura, 2014) Each year, states are authorized $1.25 to $1.75 per resident in tax credits, which the state then allocates to projects. (Kimura, 2014) Developers then bid for credits subject to requirements for projects outlined in the state's QAP. (NDC, 2006) Further, within each state, qualified non-profit organizations are entitled to at least 10% of the tax credits. (DCA, 2014) LIHTC developments tend to be complex, but a basic overview of the LIHTC requirements are as follows:

- +The maximum amount of credits that a project may receive depends on the type and cost of development, the percentage of low-income units involved, and the building's location. For new construction and rehabilitation, the tax credit rate is approximately 9% per year over ten years. For building acquisition, minor rehabilitation, and federally subsidized buildings receiving below-market rate loans, the building can qualify for a 4% per year credit. Further, a project receiving tax credits must qualify as low-income each year of the 15- to 30-year compliance period or risk recapture of some of the credits. To qualify, a building must meet one of two tests concerning rents and tenant incomes:

- +20% or more of the residential units are both rent-restricted and occupied by individuals with income 50% or less of the area median gross income (AMI), or

- +40% or more of the residential units are both rent-restricted and occupied by individuals with incomes 60% or less of the AMI. (DCA, 2014)

Because LIHTC developments are complex and often built by niche developers, they can pose special risks. One of these risks is management of the property. LIHTC projects may serve special-needs populations that require substantial social services. (Cummings & DiPasquale, 1998) Further, tax-credit projects must be managed to maintain the required number of income-eligible tenants and to ensure that the appropriate documents are filed and kept current. (Cummings & DiPasquale, 1998) Scattered site housing potentially makes the management risk even higher, if simply because the tax credit housing units are dispersed throughout a neighborhood and thus not as easy to monitor and maintain. (Cummings & DiPasquale, 1998)

Deed-Restricted Homes

Another potential tool is Deed-Restricted Housing. Deed-restricted homes encompass a range of housing. The type of housing subject to deed-restrictions may include detached houses, attached duplexes, row houses, townhouses, and condominiums. (Davis, 2006) Unlike the CLT model, the occupants of deed-restricted homes have ownership of both the land and the building. But, similar to the CLT, the owner-occupant of deed-restricted housing foregoes some of the "bundle of sticks". For example,

"[T]he owners of deed-restricted houses have exclusive use of their property, but they are prevented from using it for anything other than their primary residence. They have the right to resell their property, but they are constrained from conveying it to whomever they wish or for whatever price the market will bear. They may improve their property, mortgage their property, or bequeath their property, but there are usually contractual constraints on these ownership rights as well." (Davis, 2006)

The mechanism through which these contractual constraints are typically imposed is an affordability covenant appended to the homeowner's deed. (Davis, 2006) This covenant would require the owner-occupant to resell the property to someone from a specified pool of income-eligible buyers for a specified, formula-determined price. (Davis, 2006) This covenant may also contain a right of first refusal for the nonprofit. (Davis, 2006)

Land Trust Collaborative

Finally, a collaborative model of Community Land Trusts may enable smaller, community based land trusts to gain access to more resources and capital. This access is important because of the high costs associated with acquiring a critical mass of properties necessary to stabilize the neighborhood. Further, it may also provide a neighborhood CLT with resources capable of lowering administrative costs (an expense that can take up a large percentage of a small organization's budget).

In Atlanta, a Community Land Trust Collaborative exists. The Atlanta Land Trust Collaborative (ALTC) works by combining neighborhood-based, resident-controlled Community Land Trusts (CLTs), with the ALTC. (Atlanta Land Trust Collaborative, 2014) The ALTC functions as a "Central Server" organization that can incubate and support the development and operation of permanently affordable housing initiatives by independent non-profit CLTs, along the Beltline and throughout the City. The ALTC hopes to raise awareness of, advocate for, and implement neighborhood based CLTs. (Atlanta Land Trust Collaborative, 2014)

A potential benefit of the collaborative model for a community is the opportunity to have an organization with the financial resources and potential connections necessary to pay lobbyist and advocate for stronger tax lien foreclosures by the City of Atlanta and more property acquisition by the Atlanta Land Bank. This model may also provide a community with financial backing that would allow them to negotiate for properties from banks or the National Community Stabilization Trust.

- (1)The price-to-income ratio is based on median household income and median housing values from the American Community Survey 2008 -2012 5-year estimates. The price-to-income ratio is a simple method for determining the "relative expense of a home for a typical household." (The price-to-income ratio is calculated as follows: (median housing value/median household income).

- (2)Information and map was taken from Zillow.com and includes foreclosures, multi-family, vacant land, and single family sales for the past 6 months (November 22, 2013 - April 22, 2014)

- (3)AMI percentages represent 2013 HUD Income Limits. BeltLine affordable housing targets were taken from: http://beltline.org/wp-content/uploads/2012/04/BeltLine-Affordable-Housing-Advisory-Board_2010-Annual-Briefing-Presentation.pdf

- (4)Fee simple acquisition from the purchase of the property may originate from a homeowner, or from a foreclosure sale.

- (5)In 2011, Georgia had the fourth-highest foreclosure rate in the nation with 1 in 37 homes filing for foreclosure. Id.